Get your high risk merchant account

High risk merchant accounts allow businesses who are considered high-risk, to process payments online. Businesses looking for instant approval in the high-risk space can apply through High Risk Merchants and receive competitive rates on their merchant accounts and payment gateways.

About

High Risk Merchants provide Merchant Account Services to businesses and individuals that are just starting up, as well as established businesses that are now looking for a better payment solution. High Risk Merchants provide a stable, secure online trading environment to ensure your online business has the best chances of success. If you are ready to sell online and don’t know quite where to start, start here. Whatever your business, we have a solution.

High Risk Offshore Merchant Account Solutions

We specialize in providing offshore merchant account and third party merchant account payment solutions to international businesses.

High Risk Merchants provides a credit card and cryptocurrency payment gateway allowing you to accept payments against very competitive rates. We are experts in handling merchant payment processing for a variety of high-risk and low risk industries, both big and small clients.

So many people like this service

What are High Risk Merchant Accounts?

- High risk merchant accounts are a payment processing service for businesses in high risk industries

- A Paypal merchant account, for example, will only support businesses that are low risk

- Different factors would require you to find high risk merchant services

- Factors from credit score, chargebacks, to industry type can categorize your business as high risk

- Instant approvals for high risk accounts are uncommon but possible for established businesses

Merchant Account for any business

Lorem Ipsum is simply dummy text of the printing and typesetting industry when an unknown printer took a galley of type and scrambled..

Ecommerce

The payment solutions that we are able to offer can be quickly and easily integrated into your existing shopping basket enabling you to conduct a seamless transaction. All funds are deposited directly into you own bank account without having to go through a third party. Once your account has been approved we will provide any technical assistance that you require to ensure that you can integrate as quickly as possible.

Offshore Accounts

NEW For EU and UK customers only.

You are typically Trading in a business that is selling products or services with your customer present with or without a website. SIgnup today for fast approval with a pdq terminal.

HIGH RISK BUSINESS

If your business is classified as High Risk and you are having difficulty getting an account, or you are having difficulty maintaining an account, you need to apply for our High Risk Account.

Our Acquiring Partners understand high risk and can provide a long term sustainable account to minimize processing disruption.

Do I Need A High Risk Merchant Account?

How do you know if your business has been categorized as a high risk merchant? And why is it important to make sure you have the right merchant account for your business? It’s important to understand the difference because it can have a major impact on your business. Businesses in this category have to know who the right high risk merchant account providers are. Gateways like NMI, or Authorize.net provide solutions for high risk merchants. Whereas, Stripe merchant services and Square payment processing does not fully support industries like CBD, adult, and firearms.

How To Compare High Risk Merchant Accounts

Start Accepting Payments Today

What are the Most Common Reasons a Business might Need High Risk Merchant Accounts?

01:

The business is selling products online:

A high risk ecommerce merchant account is a type of service commonly referred to as Card-Not-Present merchants.

02:

The business is in a highly regulated industry:

Businesses like that sell CBD oils online, E-cigs, firearms, Casino, E-Gaming, Forex Trading and Adult are among a few of the many that would fall in this category.

03:

The business is in an industry that a bank may see as a reputational risk:

Companies like IT or security services deal with customer information and could be considered a reputational risk. Additionally, adult merchant accounts qualify.

04:

The business industry is known for having a high instance of chargebacks or fraud:

Merchant accounts that fall in this arena often experience increased chargebacks, identity theft, account takeover. This makes banks run in the other direction.

05:

The business sells products or services using a continuity or recurring billing model:

This type of business model brings a lot of chargebacks when clients are billed without consent or remembering they even signed up. Resultantly, many chargebacks will lead to your account shutting down entirely.

06:

The person signing on the merchant account has bad credit:

Banks are less willing to lend funds to those with bad credit. That’s when a high-risk processing company comes in handy.

How we stand out from the crowd

High Risk Merchants partner with many acquiring banks and processors around the world and are able to offer competitive rates for all high risk and low risk online merchants. We have established a close working relationship with many acquirers across the globe and have a large portfolio of banks and other acquiring partners that will be able to assist you in obtaining a merchant account for your business. Whether your business is a new start up or an established entity we will be able to provide direct and third party accounts that will suit your needs at realistic rates. The solutions that we provide are sustainable, long lasting and stable. Whatever your business situation we will have a solution for you.

WORLDWIDE

Our acquiring partner network is worldwide and includes carefully selected reliable and stable partners providing competitive rates.

HIGH RISK & LOW RISK

We offer ecommerce solutions for all types of low risk and high risk online ecommerce online and bricks & mortar businesses.

OFFSHORE MERCHANT ACCOUNT

Supporting your business with offshore accounts.

LOW RATES

Our acquiring partner network is worldwide and includes carefully selected reliable and stable partners providing competitive rates.

Merchant Account Instant Approval

Some merchants believe that they can get a high risk merchant account instant approval, but this option is very uncommon. The approval process is an involved one. High risk merchants can improve their chances of getting approved by highlighting the best features of their business and sharing documents quickly. A cover letter should include relevant information, such as the industry insight of people involved in the project. Merchants should also discuss anything that makes the business stand out, such as proactive fraud monitoring. Better yet, for the sake of longevity and financial success they should avoid companies trying to sell high risk merchant account instant approval. It’s not practical, and will often result in hindering payment processing down the line.

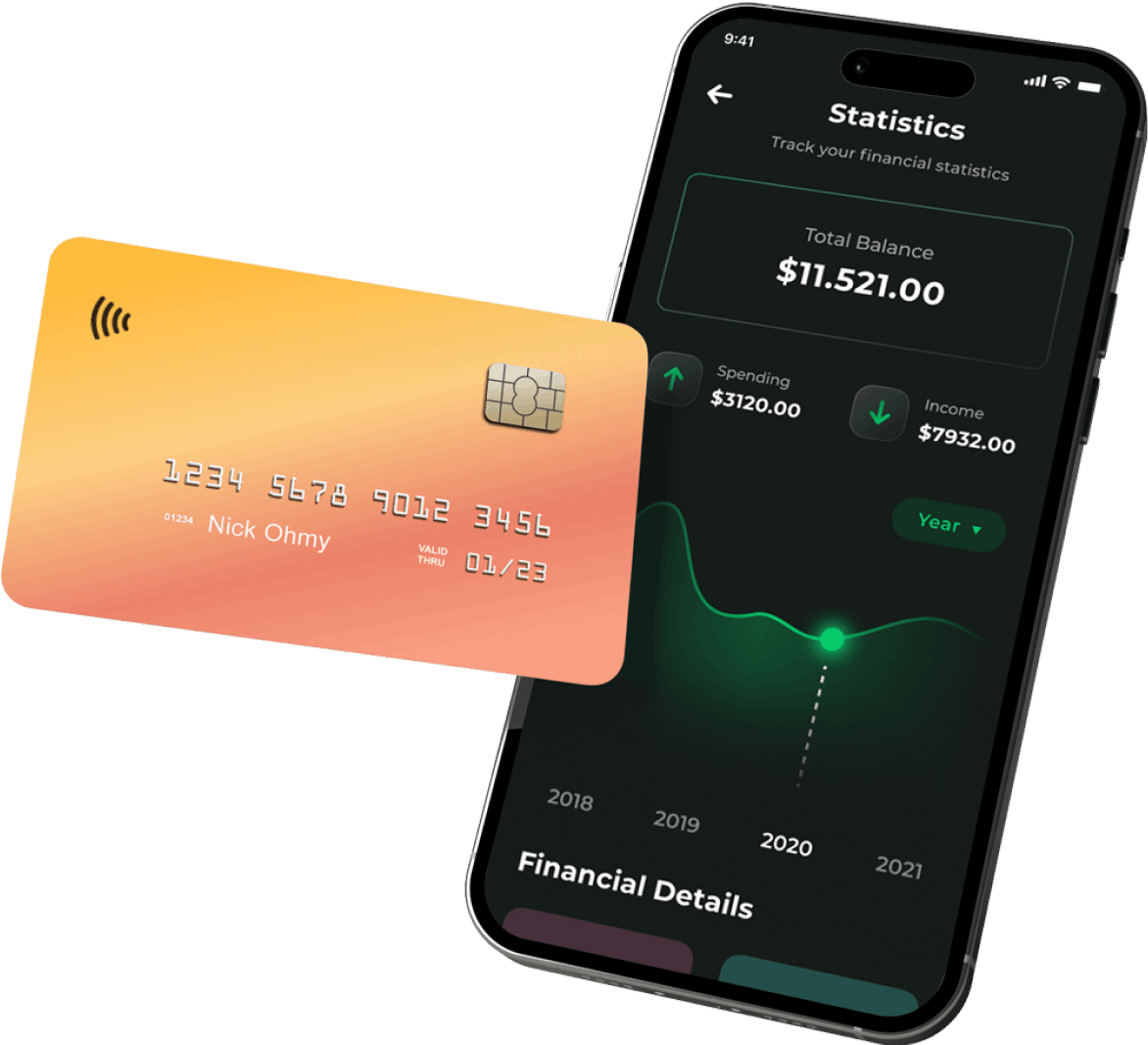

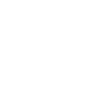

Accept all Major Cards

Visa, Mastercard, American Express, Visa Electron, JCB and others.

Fast Payment Cycle

Prompt and reliable settlement payments means you can keep your business on track.

High Risk from the outset

Reliable processing from the outset means you can trade to capacity.

Virtual Terminal

Process your payments through an online virtual terminal (VT) or use our API to integrate directly into your website.

How To Get Fast Merchant Account Approval

Address high trading volumes in a cover letter. Trading volumes impact the risk to the processing company. Showing a strong processing history with a great deal of money moving through the business can increase the chance of approval. Finally, high risk merchant accounts should have a plan to address long fulfillment duration. Fulfillment duration refers to the amount of time it takes between when payment is collected and when the service or product is delivered. The longer the fulfillment duration, the higher the risk of chargebacks. Therefore, the riskier the business. Reducing the fulfillment duration or showing strong reserves makes the merchant a lower risk.

Approval For Offshore Accounts

International businesses who need offshore merchant account providers can gain insight on how to get approved for a high risk offshore merchant account. Other things to consider about finding the right payment processor include the ratio of chargebacks that your company incurs.

High Risk Merchant Accounts and Payment Gateway Solutions

High Risk Merchants team has high risk merchant accounts for businesses with high risk payment processing volumes of $20,000-$100,000,000+ per month. Our gateway partners like NMI and Authorize.net, give you access to information regarding your new account. Including individual transactions and batch totals with comprehensive reporting tools. Merchant Payments Acceptance Corp’s end-to-end solution offers flexible products and high risk merchant account services that enable merchants to accept nearly all types of electronic payments including major credit cards: MasterCard®, VISA®, American Express®, Discover®, Diners Club International®, signature debit cards Gift and loyalty cards, and even for a high risk ACH merchant account

Frequently asked questions

Find answers about High Risk Merchants Credit Card Merchant Accounts and Payment Processing.

No, there is no charge to submit the online application, regardless of whether your application is accepted or rejected.

There are some business types and jurisdictions where a set up fee will be applicable dependent upon the amount of work involved in placement. However if this applies to your application you will be notified of the fee applicable. Please note that most merchants can be placed without a set up fee being paid but we do reserve the right to charge on should it be deemed necessary.

Weekly, we settle all our payments at the start of each week.

Our Acquiring Partners understand high risk and can provide a long term sustainable account to minimize processing disruption.

You will not require any additional hardware or resources; you will either have a Virtual Terminal or a software solution (API) that can be integrated directly into your existing shopping cart to give real time authorisation and processing.

After your initial setup costs, there will be no recurring charges or membership fees.

There are no hidden costs that will appear at a later date, what you see is what you pay.

We can provide merchant accounts in almost every country, subject to a full risk assessment.

Our merchant accounts allow you to accept payments from customers all over the world as long as they are pay using a Visa or MasterCard. (American Express and Discover on request).

Your order reference and or company name will appear on the customer’s statement. However this can be customised to the customers requirement through the High Risk Merchants Gateway.

A Payment Gateway is an eCommerce application service provider that will sit between your website and the bank. It facilitates the transfer of the buyer’s payment details (credit card and addresses) to the acquiring bank to authorise the payment. All merchants require a Payment Gateway to be able to accept payments online.

The normal setup time for the Payment Gateway for most merchants is 24 hours.

You can either take payment using a virtual terminal where you enter the payment details manually into an online system. Or, you have an integrated Payment Gateway that is attached through software to your online ecommerce shopping basket and the payments are processes automatically.

We can allow you to transition your merchant account onto our Payment Gateways – so you can start processing payments immediately.

We do not impose any long term contracts or cancellation fees.

Our system can allow recurring billing on to charge customers on daily, weekly, monthly and annually. You can totally customize this option to your individual requirements, and you can get the number of payments, the amount, the frequency of the recurring billing.

Basically, yes. We have never had a merchant that could not integrate the Payment Gateway to their shopping cart. Our Payment Gateway can be setup with all websites written in any language, as your website would be configured to post the payment data to our gateway through an XML API. Please enquire if you would like to find out more.

Yes, we provide all the relevant documentation and source code – and can usually be integrated into your website within a few hours. The full detailed instructions are emailed to you as soon as the Payment Gateway is setup.

The “risk” associated with Merchant Accounts (High risk, low risk etc.,) is determined from the nature of the business; businesses that are normally classified as high risk usually include adult websites, gambling, Casino, pharmacy…etc. These types of business will have a high chargeback and refund possibility, as customers may not be happy with their purchase. Businesses that are considered to be possible fly-by-night businesses can also be considered to be high risk. Low Risk is generally normal retail business trading on the internet.

You must be at least 21 years of age and you must provide proof of ID.

Merchants can have total flexibility of how they would like their online store to function as well as getting one flat processing rate for credit card transactions, whereas normally companies are issued with approximately 30 different rates for each different type of card. You may be able to get a better discount rate through PayWorld saving you money. Merchants can also have their funds transferred into any account worldwide – offshore account – to get additional taxation benefits.

We have no maximum transaction value, but we do have a minimum transaction value. The minimum transaction value (in US Dollars) must exceed $1.00

Our merchant accounts are suitable for merchants who wish to sell downloadable content (in digital format, usually emailed / downloaded) and physical products or services.

You would need to contact customer services and provide details of the relevant transaction. High Risk Merchants will then refund the customer on your behalf.